Salary Calculations in a Modern Workforce: A Comprehensive Guide

In the present day, the world economy is characterized by rapid developments and globalization, and understanding the method of salary calculations is no longer limited to accountants and HR people. It is now the view of the whole spectrum of people including employees, freelancers, business owners, and job seekers who want to understand how their pay has been determined, what deductions are applicable, and how their compensation rates are in comparison to others in the same industry or across countries. The demand for salary transparency has become one of the important aspects of the present-day corporate culture mainly influenced by remote work, hiring of workers from different countries and digital payroll systems.

The major part of this change is played by the salary calculation tools which allow people to get an accurate and swift estimation of their earnings. If you are analyzing a job offer, preparing a company budget, or administering an international team, being aware of the salary calculations would be a great help in the process of financial planning and decision-making.

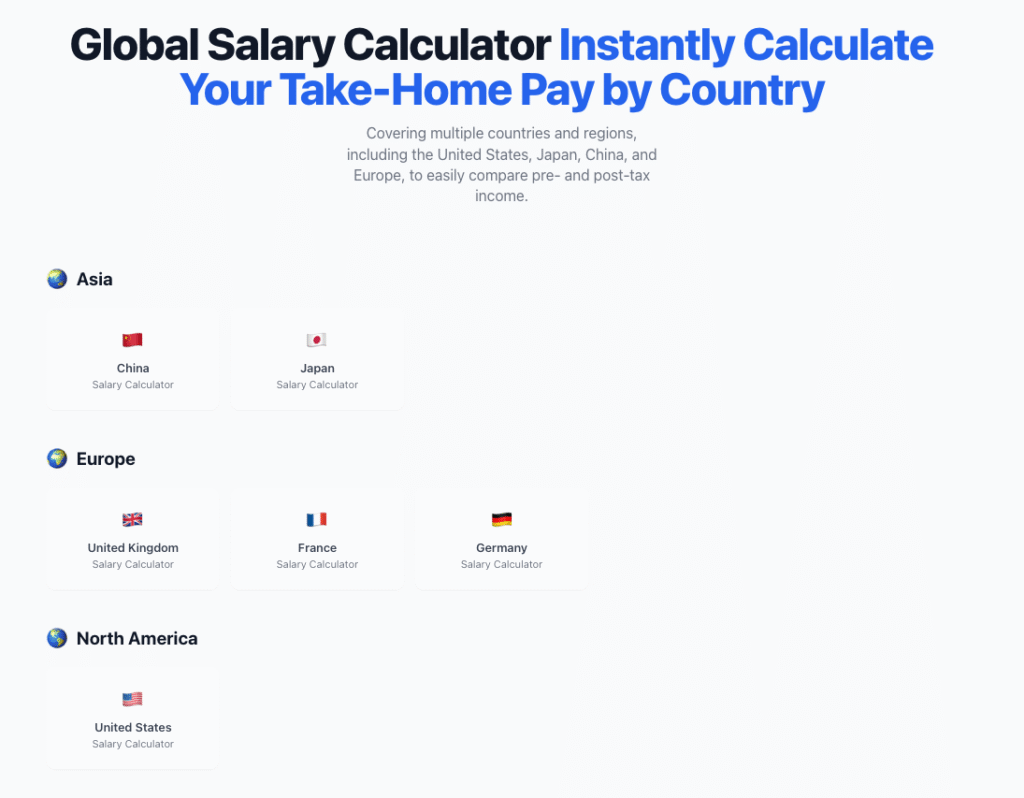

The article describes the salary calculation scenario from all possible perspectives, namely, the main factors that make up a salary, regional and global differences, the effect of taxes and benefits, and how modern tools like a global salary calculator or us salary calculator have turned the once complex and slow process into a smooth and quick one.

The Fundamentals of Salary Calculation

Salary calculation is essentially the process of determining the total amount that an employee will earn for a specific time frame—monthly, bimonthly, weekly, or yearly. Yet, this uncomplicated definition conceals a multitude of factors that are responsible for the final net pay.

Gross salary

It is the whole compensation that is agreed upon by the employer and the employee before any deductions. It can consist of base pay, bonuses, overtime, and allowances.

Deductions

Deductions lower gross salary to net pay. These usually comprise income tax, social security contributions, retirement savings, health insurance premiums, and any other compulsory or voluntary deductions.

Why Salary Calculation Is More Complex Than It Seems

On the other hand, if the salary calculation were to be considered only in terms of its definition, it would be a problem-free thing; however, the reality is that there are some scenarios where things might not be so clear-cut. Besides, countries have different tax laws, labor regulations, and benefit requirements, which might even vary from one region to another within the same country.

- Local and national tax laws

- Mandatory social security or pension contributions

- Healthcare systems and insurance structures

- Currency exchange rates for international employees

For organizations operating across borders, these variables multiply quickly. What is right for one country may be absolutely wrong for another, thus making the accurate salary calculation a strategic necessity rather than a simple administrative task.

The Rise of Salary Calculation Tools

In earlier times, salary calculations used to be done manually or with the aid of basic spreadsheets. The methods were functional but still, they were error-prone and required constant updates to keep them in line with changing tax laws. Nowadays, digital salary calculators have transformed the way compensation is estimated and managed.

- Salary calculators of today’s era provide:

- Estimates of taxes and deductions in real-time

- Personalization according to place of residence, function, and payment interval

- Transparent division of gross income and net income

- What-if analysis for the elevation, bonus, or change in perks

These gadgets have become common not only among companies but also among employees who want to have a clear understanding and certainty about their remuneration.

Global Salary Calculation in a Borderless Economy

With remote work becoming the norm, companies are hiring talent from all corners of the globe more and more. This alteration has resulted in the demand for an accurate global salary estimation to be met. A global salary calculator enables employers and employees to have an understanding of how the different countries and currency compensations are, as well as taking into account the local taxes and labor laws.

The calculation of global salaries presents a number of difficulties:

Currency differences

Exchange rates are unstable and therefore they have an impact on the real value of incomes. Salary calculators play the role of a standard by converting the pay to a selected currency for making comparisons.

Tax systems

There are different income tax brackets, social contributions, and filing requirements in every country. A global approach is used to guarantee compliance and transparency.

Cost of living adjustments

Living expenses are usually the reason for salary adjustments in a particular area. The tools that consider these differences are helping to build fair and competitive compensation packages.

Benefits and statutory requirements

Maternity leave, parental benefits, health care subsidies, and retirement systems are some of the areas where variations are huge. The correct salary calculation must take these obligations into account.

Teams that are spread over the globe can expect to see the salary calculation tools as a common framework that will enable them to be fair, compliant, and efficient.

Salary Calculation in the United States: A Unique Landscape

Salary determination in the United States offers its own unique set of challenges. A mixture of federal and state taxes, and in some cases also local taxes, are to be considered, and the way benefits are structured is also different from the rest of the world.

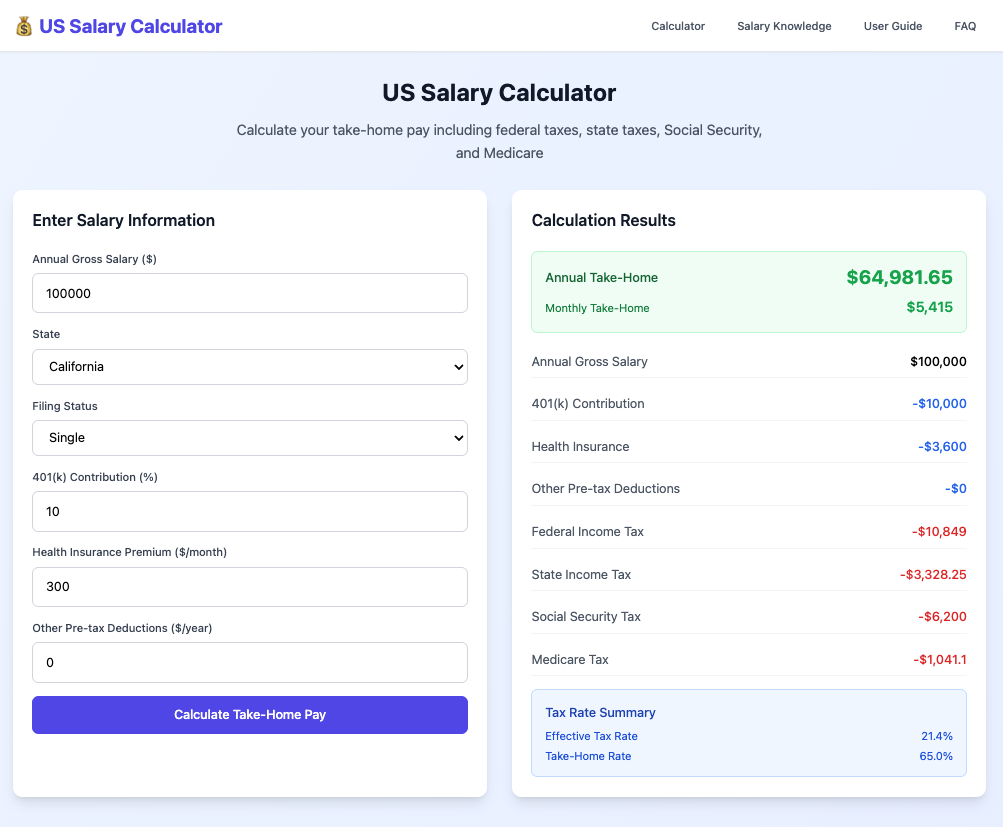

A typical salary calculator for the US includes:

Federal income tax

The tax is levied at a progressive rate that is subject to periodic change.

State and local taxes

There are states that impose very high income tax rates, while there are states that impose no income tax at all. Local taxes can also apply in certain cities or counties.

Social Security and Medicare

Payroll taxes are collected for these programs, which have specific contribution limits and rates.

Health insurance and retirement contributions

A large number of U.S. workers participate in company-sponsored health insurance plans and retirement plans such as 401(k).

Job offers are generally made in terms of gross amounts, but it is net pay that employees are really interested in.

Moreover, two positions with identical gross remuneration could end up providing vastly different net payment depending on:

- Tax rates in the worker’s area

- Benefit deductions

- Filing status and kids

- Voluntary contributions to saving or insurance schemes

Salary calculators eliminate this discrepancy by revealing precisely how gross remuneration is converted into net payment, enabling people to take informed decisions.

Salary Calculation for the Various Types of Employment

The payment methods for the different workers are not the same, and salary calculation depends on the employment type.

Full-time employees

Usually receive a fixed salary along with standard benefits and statutory deductions.

Part-time employees

Might get hourly wages with the same proportion of benefits and deductions.

Freelancers and Contractors

Generally get gross payments without any deductions, thus making them responsible for calculating and setting aside taxes for themselves.

Commission-based roles

The salary varies with performance, which requires the usage of a different salary calculation method.

Contemporary salary tools enable the modeling of these distinct arrangements by the users and are thus helpful to both the workers and the employers in understanding the financial implications of each structure.

Accuracy in Salary Calculation- A Trustworthy and Transparent Way

Accurate salary calculation is a major factor in winning the trust of the employees. Employees who are aware of the process of calculating their pay are more likely to feel they are getting quality service and are being treated fairly.

Employers who have a clear salary structure and use a reliable calculation method show their professionalism and compliance. Moreover, it also facilitates the process of the communication regarding the changes in compensation, promotion or benefits updates.

In an era of cut-throat competition for jobs, the companies that practice transparency are not just doing the right thing but are also taking the wrong route in terms of strategy.

Salary Calculation and the Future of Work

The future of work is flexible, remote and global. Salary calculation will be one area that will depend on this flexibility. Companies that will accept hiring without considering the location will need to be very careful in their compensation practices to be just and accurate.

- Salary calculators are expected to provide the following features:

- Data on living costs that will be updated in real time

- Automatic adjustments based on the current exchange rates

- Tax optimization insights tailored to individuals

- Better compatibility with money management tools

These advancements will give more power to both the employees and employers.

Final Thoughts

Salary calculation is not a hidden behind-the-scenes administrative task anymore; it is a significant factor in today’s work life. The differentiation between understanding your net income, managing a global workforce, supporting better decisions, increasing transparency, or creating financial confidence can all be traced back to accurate salary estimation.

With the appropriate instruments, a seemingly difficult task can be turned into an easy-to-handle one, such as when you use a global salary calculator to deal with international compensation or a local salary calculator to estimate deductions and take-home pay. The work context is evolving, and getting the ability to compute salaries accurately has become a necessary skill rather than a good practice.

Read More Informative Information At Mypasokey